Table of Content

With personal property tax only the assessed value of the home itself is considered for taxation. Mobile home owners often ask a real estate broker to help find a buyer for the mobile home in return for payment of a commission from the proceeds of. A real estate broker typically locates prospective buyers, obtains offers from the buyers, and conveys the offers back to the owner for final approval and acceptance. A real estate broker does not usually have possession of the property or the authority to transfer title to or possession of the property.

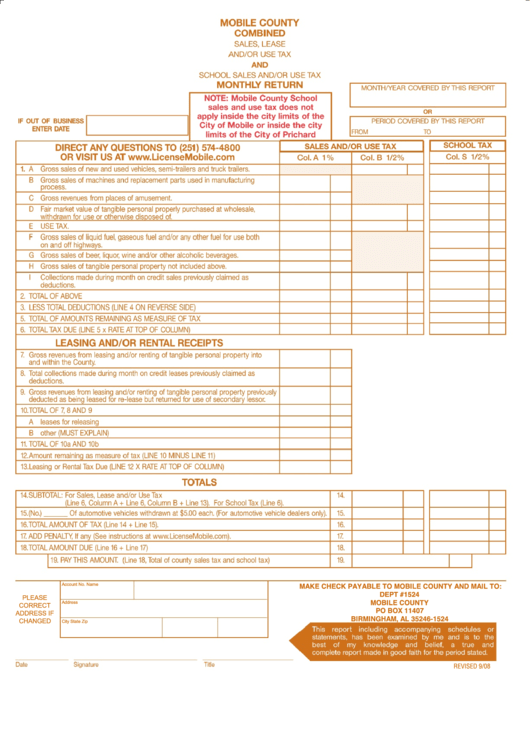

However, taxation on personal items is determined by the local taxation authority where you and your belongings reside. Before you begin the process of buying a manufactured home, you’ll want to be aware of whether you’ll have to pay sales tax and the amount of tax you’ll owe. Usually, the easiest way to find this out is to contact the seller you’re working with or to find it on your state government’s website. Homebuyers who purchase a manufactured home from a private seller or from another state will often have to pay a use tax to their state or county government after the purchase is completed. You’ll need to contact state or county revenue authorities to determine the correct amount of tax to pay and where to send it.

Manufactured Homes

All manufactured home on a permanent foundation approved under Health and Safety Code Section 18551. InterestPast due taxes are charged interest beginning 61 days after the due date. You must file a copy of the completed Application for Title/Registration of Mobile Home with the county the home was previously located in. If you bought a used mobile home, the home's previous owner must sign the title over to you. If the title does not have a Bill of Sale on the back, you must bring the Bill of Sale.

One possible advantage is that paying taxes on the property is made in two partial payments yearly. For tax purposes, in Texas, mobile homes that are fixed to the ground on permanent foundations are not considered “mobile” homes, but are treated as modular homes and, therefore, have always been taxed in the same way as conventional homes. Many counties provide online applications on their website. A list of contact information for all California Clerks of the Board offices. Once the manufactured home has been installed on an approved permanent foundation, the entire manufactured home and all attached accessory improvements become assessable as real property and are valued in the same manner as a conventional home. Section 5803 of the Revenue and Taxation Code specifically provides that the assessed value of a manufactured home on leased or rental land is not to include any value attributable to the particular site where the home is located.

Sales Tax Bulletin - Mobile Manufactured and Modular Homes

Sales of new mobile homes are subject to the Maryland 6 percent sales and use tax and the rate is applied to 60 percent of the taxable price. On the other hand, if you own the land the home is on as well as the home, you will pay your real estate tax bill. The bill should be paid to the local government where your home is located. A statutory definition of the term "mobile home" can be found in chapter 140 of the General Laws, which includes a series of provisions that regulate mobile home parks.

In that case, your lender will make the payment for you from the escrow account. We remind you that you will have to pay council tax if you live in a mobile home full time. However, the amount wouldn’t be as high as it would be if you live in a house or apartment. The other good news is that the amount you are taxed for the property is almost always deductible. The manufactured homeowner shall immediately attach the registration decal to the manufactured home. At all times thereafter, the decal should be displayed at eye level on the outside finish of the manufactured home for which the decal was issued.

Sales and Use

On April 10, it also becomes delinquent and incurs a delinquent penalty. Likewise, if you fail to pay any supplemental tax bill installment by the applicable delinquency date, the same penalty accrues as for delinquent annual taxes. There is no provision for an installment plan of redemption for delinquent manufactured home property taxes. Once seized, if a mobile home isoccupied or unoccupied with a lower value,themobile home will be sold “in place”. This sale will take place on the second floor of the Hunt County Court House in the common area at a time and date designated by the posting of a“Notice of Tax Sale”. The purchaser at a Tax Sale accepts responsibility of any eviction process which may be required to gain possession of the property.

For the most accurate and up-to-date information on mobile home sales tax, consult your mobile home dealer or a real estate attorney. If the mobile home was originally purchased on the 1st of July 1980 or after that date, it was already subject to automatic payment of local taxes on the property. Also, if your home’s license fees mobile, regardless of its original purchase date, were declared in arrears on or before May 31, 1984, from that date, the mobile home was automatically converted to the local property tax system. Finally, it is important to note that the mobile houses subject to the local tax system on the property are exempt from paying taxes on the use of goods or sales. Therefore, you will be able to increase the sales potential of your mobile home by voluntarily converting to a local property tax system before selling it.

Contact information for all California county assessors' offices. A property tax consultant can help assess the taxes owed on these types of properties as well. In some cases, even renters have to pay taxes on the mobile home.

However, many states do levy a real estate transfer tax on real estate transactions and/or a capital gains tax if you sell your home at a profit. You can check the list of real estate transfer tax states to find out if your state has a transfer tax and calculate your capital gains tax using one of the many calculators available online. Fifty percent (50%) of the sales price of each manufactured home or modular home sold at retail, including all accessories attached when delivered to a purchaser, is subject to the general 4.75% State rate of sales and use tax. Manufactured homes and modular homes are not subject to the local and transit rates of sales and use tax. In addition, the first $20,000 or $30,000 of a manufactured home's market value may be exempted from the vehicle license fee if the manufactured home is owned and occupied as a principal place of residence by a blind or disabled veteran. The exempt amount depends on the household income of the veteran.

If you put your mobile home on land that you own and it is "permanently affixed" to the ground, then the home is classified as "real property" and it will be subject to annual county property tax, just like a site-built home. Your county tax collector can determine if the home is permanently affixed. This sale will take place at the storage facility location, at a time and date designated by the posting of a“Notice of Tax Sale”. As stated above, all retail sales in Massachusetts of tangible personal property are subject to tax, unless otherwise exempted. Casual and isolated sales by a vendor who is not regularly engaged in the business of making sales at retail are exempted from the sales tax.

Before sharing sensitive information, make sure you’re on an official government site. A .mass.gov website belongs to an official government organization in Massachusetts. From there, links for filing deadlines, the Assessment Appeals Manual, a video discussing the appeals process, frequently asked questions, and other publications are available. Initiate seizure and sale of the manufactured home at a public auction. To calculate interest on past due taxes, visit Interest Owed and Earned. The SCDMV will provide written confirmation that the home has been de-titled.

Before sharing sensitive or personal information, make sure you’re on an official state website. Furthermore, as a reminder, a mobile home is movable property , so there are no notary fees. And monthly on the last day of the month following the end of each calendar month for property tax. In addition to primary school, attend secondary school, secondary school and private school . In order to walk around and make wholesale purchases, take the car for about 10 minutes. Beautiful historic downtown with restaurants, such as "Mother Kraus", even with popular and well-known guests.

Manufactured homes are subject to Proposition 13 under which the county assessor determines the base year value of a manufactured home, which is generally the market value at the time of purchase. Thereafter, annual increases to the base year value are limited to the inflation rate, as measured by the California Consumer Price Index, or 2 percent, whichever is less. Any new construction will have its own separate base year value. When the manufactured home is sold, it will be reassessed at its current fair market value and a new base year value will be established. If your manufactured home is located on land that you own, the land will be assessed separately.

No comments:

Post a Comment